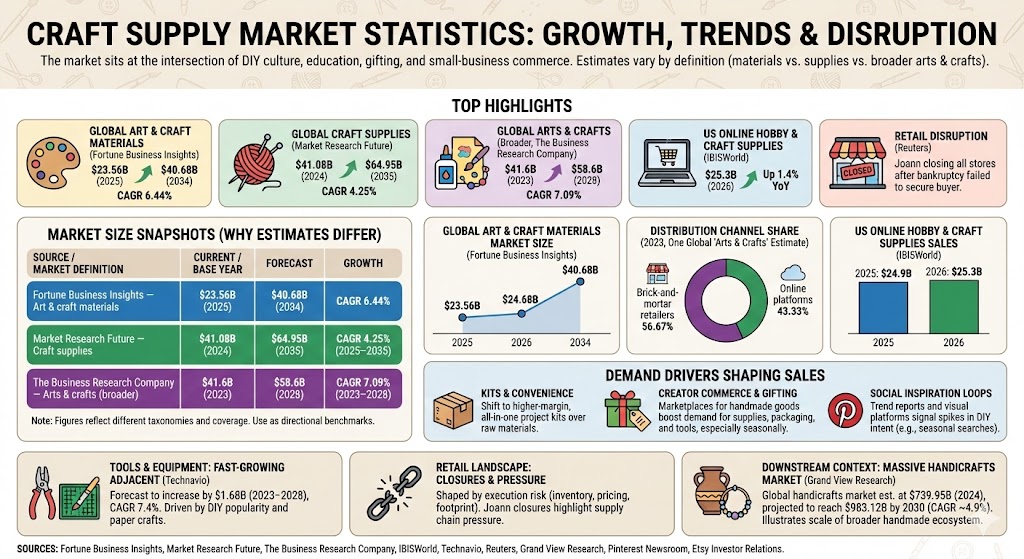

The craft supply market sits at the intersection of DIY culture, education, gifting, and small-business “maker” commerce. Because research firms define the space differently (e.g., art & craft materials vs. craft supplies vs. broader arts & crafts), published market-size estimates can vary widely—so it’s best to compare figures within the same source and definition.

Craft Supply Market Statistics (Top Highlights)

- Global art & craft materials: valued at $23.56B (2025) and projected to reach $40.68B (2034) (CAGR 6.44%), per Fortune Business Insights.

- Global craft supplies: estimated at $41.08B (2024) and projected to reach $64.95B (2035) (CAGR 4.25%), per Market Research Future.

- Broader global arts & crafts market: estimated at $41.6B (2023) and projected to reach $58.6B (2028) (CAGR 7.09%), per The Business Research Company.

- Distribution mix (2023): brick-and-mortar retailers accounted for 56.67% of sales vs. 43.33% for online platforms (within one “arts & crafts” market estimate).

- US online hobby & craft supplies: industry revenue expected to be $25.3B in 2026 (up 1.4% YoY), per IBISWorld.

- Retail disruption: Joann (a major US fabric/crafts chain) announced it would close all stores after bankruptcy-related sale efforts failed, per Reuters.

Market Size Snapshots (Why Estimates Differ)

These figures are not “one definitive number” for craft supplies; they reflect different taxonomies and coverage (materials-only vs. tools vs. kits vs. broader arts/crafts categories). Use them as directional benchmarks and trend indicators.

| Source / Market Definition | Current / Base Year | Forecast | Growth |

|---|---|---|---|

| Fortune Business Insights — Art & craft materials | $23.56B (2025) | $40.68B (2034) | CAGR 6.44% |

| Market Research Future — Craft supplies | $41.08B (2024) | $64.95B (2035) | CAGR 4.25% (2025–2035) |

| The Business Research Company — Arts & crafts (broader) | $41.6B (2023) | $58.6B (2028) | CAGR 7.09% (2023–2028) |

Chart: Global Art & Craft Materials Market Size (Selected Years)

Values below are USD billions from one market definition (Fortune Business Insights) to show the growth curve within a single dataset.

| Label | Bar | Value | ||

|---|---|---|---|---|

| 2025 |

| 23.56 | ||

| 2026 |

| 24.68 | ||

| 2034 |

| 40.68 |

Max = 40.68. Widths: 2025 57.92%, 2026 60.67%, 2034 100.00%

Chart: Distribution Channel Share (One Global “Arts & Crafts” Estimate, 2023)

This channel split comes from a single “arts & crafts” market model and is useful as a directional indicator of the ongoing shift online.

| Label | Bar | Value | ||

|---|---|---|---|---|

| Brick-and-mortar retailers |

| 56.67% | ||

| Online platforms |

| 43.33% |

Max = 56.67%. Widths: Brick-and-mortar retailers 100.00%, Online platforms 76.46%

Chart: US Online Hobby & Craft Supplies Sales (Market Size)

IBISWorld’s US online hobby & craft supplies category shows a large e-commerce base for supplies, kits, and related products.

| Label | Bar | Value | ||

|---|---|---|---|---|

| 2025 |

| $24.9B | ||

| 2026 |

| $25.3B |

Max = $25.3B. Widths: 2025 98.42%, 2026 100.00%

Demand Drivers Shaping Craft Supply Sales

- Project kits and convenience: online craft retail has increasingly leaned into higher-margin, all-in-one kits rather than only raw materials (a pattern highlighted in industry commentary for online craft sales).

- Creator commerce and gifting: marketplaces that concentrate handmade and personalized products act as “demand multipliers” for supplies, packaging, and tools—especially around seasonal gifting cycles.

- Social inspiration loops: trend reports and visual platforms regularly signal spikes in DIY intent (e.g., seasonal craft searches and activity planning).

Tools & Equipment: A Fast-Growing Adjacent Category

Beyond consumables (paint, paper, yarn, glue), the tools side of crafting can show faster growth in certain niches. Technavio forecasts the arts and crafts tools market to increase by $1.68B from 2023 to 2028, at a CAGR of 7.4%, citing DIY popularity and paper crafts among key drivers.

Retail Landscape: Store Closures and Supply Chain Pressure

The craft supply market is also shaped by retail execution risk—inventory availability, pricing, and store footprints matter. Reuters reported that Joann (a major US crafts and fabric retailer) planned to close all stores after failing to secure a buyer to keep operations running, following repeated bankruptcy filings and persistent supply chain disruption.

Downstream Context: The Handicrafts Market Is Massive

Finished handmade products create demand for craft inputs. One benchmark: Grand View Research estimated the global handicrafts market at $739.95B in 2024, projecting it to reach $983.12B by 2030 (CAGR about 4.9%). While handicrafts are not “supplies,” the scale illustrates how large the broader handmade ecosystem is.

FAQ

How big is the craft supply market globally?

It depends on the definition. Published estimates for “craft supplies,” “art & craft materials,” and broader “arts & crafts” markets can differ significantly, with base-year values in the tens of billions of USD in major market research models.

Is craft supply spending moving online?

Yes—market models and industry trackers show online platforms gaining share, and US online hobby & craft supplies sales alone are measured in the tens of billions of dollars annually.

What’s changing fastest: materials, tools, or kits?

Many retailers are pushing kits (convenience + higher basket sizes), while tools can post strong growth rates in certain categories due to repeatable, upgrade-driven purchases.

Sources

- Fortune Business Insights — Art & Craft Materials Market

- Market Research Future — Craft Supplies Market

- The Business Research Company — Arts and Crafts Market

- IBISWorld — Online Hobby & Craft Supplies Sales (US)

- Technavio — Arts and Crafts Tools Market

- Reuters — Joann store closures

- Grand View Research — Handicrafts Market

- Pinterest Newsroom — Trend reporting (DIY search signals)

- Etsy Investor Relations — Active buyer metrics